Pay-per-click advertising (PPC) for tax professionals is unique because your target audience has high expectations, and your window to meet them is small. However, leveraging a few specialized techniques for maximizing PPC during tax season can make a world of difference. On this page, we’ll cover a few tips to help you kick your tax season PPC strategy into high gear and lock in new clients before the filing date hits.

1. Align All Your Tax Season Digital Marketing

Your audience isn’t only going to see your PPC tax service advertising. They’re likely to see multiple campaigns and engage with your brand on several platforms before they take action. Spend time developing a cohesive strategy so that all your marketing initiatives are targeting the same personas, leveraging the same value statements, and containing identical branding. This will make your advertising more effective and boost your return on investment (ROI).

You may also want to pair your tax return PPC campaigns with helpful content, such as answers to common tax-related questions, educational articles, and tax guides or tips. These can be leveraged as part of your campaigns or help build organic traffic that you can reach through retargeting later.

2. Identify Your Metrics

Each brand will have unique goals and may use different metrics to measure success as a result. Before you begin creating campaigns, decide which key performance indicators (KPIs) align with your goals, which ones you’ll focus on, and how often you’ll review them.

Bear in mind that because tax season offers a very limited widow, you will likely want to review your metrics more often and refine campaigns more frequently to ensure they’re running as effectively and efficiently as possible before the season peaks.

A few KPIs you may want to keep an eye on include:

- Quality Score: A high Quality Score indicates your ads deliver a good user experience and may allow you to win at auctions with a lower bid.

- Impressions: Each time your ad is viewed, it’s logged as an impression. Generally speaking, a high number of impressions is better, though impressions have little value if the right people aren’t seeing your ads.

- Impression Share (IS): Your IS is the percentage of impressions your ads actually receive compared to the number they could. A high IS indicates your ads are outperforming other ads in the same category.

- Average Position: Generally speaking, a high average position is better because it means your ads appear higher on the page, which typically increases clicks.

- Clickthrough Rate (CTR): Your CTR is the percentage of people who click your ads compared to impressions. A high CTR is usually better, though it’s important to ensure you’re getting quality traffic to your site, too.

- Conversion Rate (CVR): Your conversion rate is the percentage of people who took action on your landing page compared to the number of people who could have. Higher is typically better.

- Cost per Click (CPC): Generally speaking, you want to pay the least amount possible for each click. However, it’s essential to consider your customer lifetime value (CLV) when determining how much to spend to prevent underbidding and missing out on quality lead. It’s also worth noting that the average Google Search CPC in the finance industry is $4.01, while Microsoft comes in at $1.82. as our benchmark report indicates. You should anticipate an uptick during tax season, especially on keywords with lots of competition.

- Cost per Acquisition: Like CPC, a lower cost per acquisition is usually better.

- Return on Ad Spend (ROAS): On average, PPC doubles your investment, as Search Engine Land reports. Keep an eye on yours, but also consider CLV when you’re measuring ROAS, too.

3. Address Tracking

Hopefully, you already have tracking set up from previous campaigns. Double-check that each conversion and its source are being logged. This is crucial to finetuning or optimizing your campaigns as tax season kicks into full swing.

Also, ensure that you have retargeting pixels set up for each platform you intend to use. These allow you to continue advertising to people after they’ve left your website. Dynamic remarketing doubles conversions and CPA by 60 percent, according to Google. This makes it imperative to maximize the impact of your campaigns now and will allow you to reach people throughout the year with other offers to keep your firm busier after peak season winds down.

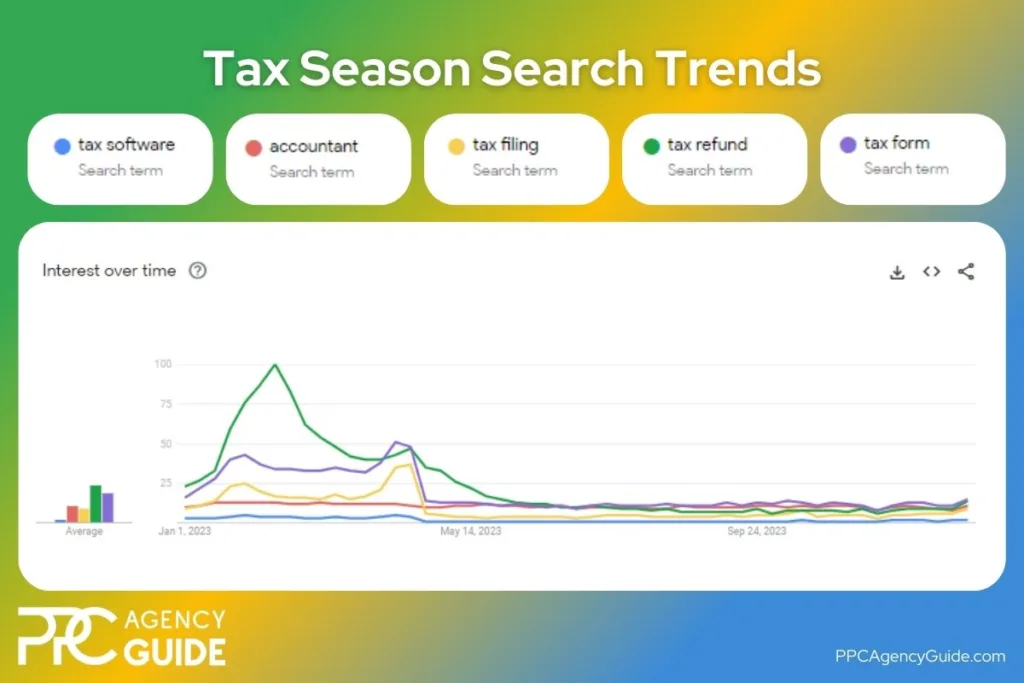

4. Allocate Your PPC Budget Based on Trends

Some brands can simply divide their annual budget by 12 to determine a monthly budget. However, finance pros must consider a seasonal budget adjustment for PPC. As we can see in the Google Trends data below, interest in tax-related terms begins in January and continues through April. The first spike corresponds with the timeframe in which people receive their W-2s from employers, which is at the end of January or the start of February. The second spike corresponds with the final tax filing deadline. For a deeper dive into finance-specific PPC strategies, check out our dedicated Finance Industry section.

If the health of your business depends on having a successful tax season, you’ll likely want to spend most of your annual PPC budget between January and April, with additional spend allocated for the peaks. Your tax season PPC bid management strategy should also involve allocating additional funds for the peaks as competition rises. When planning your tax season budget, it’s crucial to consider specific strategies like PPC for financial services, which can help optimize spending and maximize returns in a highly competitive industry.

5. Skip the Promotions; Offer Transparency and Value

While most PPC advertising thrives on discounts and special promotions, the finance industry often gets a pass in this regard. People tend to be more concerned with your qualifications and what you can do for them.

In lieu of a promotion or discount, consider:

- Highlighting value

- Using terms like “maximum refund” to demonstrate savings

- Providing clear, transparent pricing

If you feel a promotional offer is vital to campaign success, try running one as an A/B test.

6. Target Your Audience

If you normally run PPC campaigns, you can likely target the same personas you usually do. If you don’t normally run PPC campaigns, develop personas that represent your actual customers. Remember that you can target at both the campaign and ad group levels. Although how you approach this is up to you, it’s generally a good idea to create distinct campaigns for vastly different audiences, such as B2B vs B2C. This is because their keywords, journeys, and messaging are generally distinct. The results will be, too. However, you can tweak targeting by ad group if you’re reaching similar customer bases.

7. Consider Multiple Ad Formats

There are many innovative PPC formats for tax services, and each may have a place in your strategy. Consider working with:

- Search Ads: Leverage search ads to reach people who are already looking for your products or services. Your text ads will appear alongside organic results on search engines like Google, Bing, and Yahoo.

- Display Ads: Reach people on third-party websites using text and visual content with display ads.

- Video Ads: Engage viewers with quick and compelling clips about the benefits you offer using video ads.

- Mobile Ads: Catch people on tablets and smartphones with mobile ads – a must for local businesses such as tax specialists and accountants leveraging strong geotargeting that hopes to generate foot traffic.

- Mobile App Ads: If your business offers an app like tax filing software, increase downloads with mobile app ads.

8. Diversify Your Keywords

As we saw earlier, search volume skyrockets for tax-related terms like:

- Tax software

- Accountant

- Tax filing

- Tax refund

- Tax form

Following PPC keyword trends for tax season like these can help you get more impressions and clicks. You can also use terms like “IRS” in search advertising. It may allow you to gain an edge because the IRS doesn’t advertise.

However, virtually all savvy tax-related businesses will be targeting these keywords during tax season, which makes it more challenging to get your ads to display and drives up the cost. Be sure to pair this with long-tail keywords, which tend to have less competition and can help you reach your specific personas better.

9. Employ Additional Optimization Strategies

Leveraging additional tax-related PPC optimization strategies will boost your overall results.

Trust Signals

People are especially wary of finance businesses online. You must give readers many reasons to trust you before they’ll consider accepting your offer. Include trust signals at every stage of the buyer journey, including in your ad copy, landing page, and near your call-to-action (CTA).

Let’s use TurboTax as an example. The brand’s landing page includes a lock on the login button to show us it’s secure. They also include a link to their guarantee to boost confidence. And, because they show us CPAs and tax experts with decades of experience, the trust we’d place in these professionals automatically transfers to the brand.

But, they don’t stop there. They also include privacy and security badges further down the page and an e-file provider badge to show that the IRS trusts them. Readers are consciously aware of these signals, but they pick up on them subconsciously, boosting trust.

Countdowns

Many platforms like Google allow you to include countdowns in your ads. Experiment with options such as “days left to e-file” or similar.

Extensions

Ad extensions can sometimes appear with your ads, depending on the ad provider’s algorithm and your ad formats. It’s worth setting them up even if they don’t always display because brands can see a 20 percent increase in clicks when they are used, Google reports. A few that tend to work well during tax season are highlighted below.

- Callouts: Highlight important selling points and key information that aren’t already parts of your ads. These aren’t clickable, but they can give readers more information. For instance, yours might include “Quality Guaranteed” or “Audit Support.”

- Structured Snippets: Similar to callouts, structured snippets are non-clickable bits of text that appear with your ad. However, they differ because they’re limited to the ad platform’s categories. For instance, if you’re a tax service provider, you could use the service catalog designation and list all your services.

- Sitelink: Sitelink extensions link to specific pages on your website. For instance, you might want to link to your support, special tax-related tools, or related products.

- Lead Form: Service providers may also benefit from gathering leads directly from the ads. For instance, if your business is well known in your region, perhaps your form could involve requesting an appointment or a free consultation.

- Call: A call extension includes your phone number so people can reach you easily. While the benefit is obvious for service providers, it can also help build trust if you’re selling software or some other type of virtual good.

- Location: Local service-based businesses often benefit from including an address. Be aware that you can only choose from locations the ad platform already knows are yours.

- Promotions: Promotion extensions have some limitations. For instance, you’re usually required to choose exclusively from a dollar-off or percentage-off option. Because of this, they’re generally not ideal for finance businesses, but they can work if you’re selling goods, like software, at a discount or are offering a promo code.

- Image: Include images with your ads to make them pop. For the best results, try to avoid stock photography and focus more on your products or actual images of the team providing services.

Negative Keywords

A lot of focus is placed on selecting good keywords, but leveraging negative keywords can be just as important. Include words you know aren’t appropriate for your business as you set up your ads, and keep an eye on the actual searches once your ads are running so you can prevent your ads from displaying when a search isn’t a good match.

For instance, many service providers will run ads for the phrase “tax.” However, that also means your ad appears for searches like “tax software” and “tax specialist jobs.” You would likely want to add “software” and “jobs” to your negative keywords.

A/B Testing

A/B testing is imperative for tax season ad copy strategies because it allows you to identify which ads resonate with your personas. However, you should also test images, headings, offers, and landing pages, too.

Quality Score

Your quality score is a measurement of the overall ad experience you provide. Try to improve your quality score as much as possible to boost impressions and clicks.

Adjust Campaigns Based on Real-Time Data

Keep an eye on your campaigns and spend a few hours optimizing them each week. Add negative keywords and remove low-performing ads and ad groups. This will funnel more of your budget to areas delivering ROI.

10. Develop a Landing Page Designed for Conversion

Don’t send people to your homepage. You’ll get more conversions if each ad group has its dedicated landing page with the same messaging and tone as the related ads. Keep it simple and clean while including essential elements such as a contrasting CTA and trust signals.

Get Help Strengthening Your Tax Season PPC Strategy

You have a very small window to develop and optimize your tax season PPC strategy. Bring on an expert to ensure optimal results. Request your complimentary PPC consultation today.